How to Save Tax on Private School Fees Using a Family Trust – Especially as VAT on Fees Rises

Private school fees in the UK are already a significant financial commitment, and with the planned introduction of VAT on private school fees, the cost is set to rise even further. However, with careful tax planning, families can reduce this burden and save up to £5,000 per child per year using a family trust.

VAT on Private School Fees – What’s Changing?

The UK government has announced plans to remove the VAT exemption on private school fees, meaning that fees could increase by 20%. For many families, this could add thousands of pounds per year to their education costs.

For example:

• A school charging £15,000 per year will see fees rise to £18,000 with VAT added.

• A school charging £25,000 per year will rise to £30,000 under the new VAT regime.

This increase makes tax-efficient planning even more critical for parents looking to mitigate costs.

Using a Trust to Save on School Fees

One of the most effective ways to legally reduce the tax burden when paying for private school fees is through the use of a family trust. This allows families to take advantage of a child’s personal tax-free allowance (£12,570 per year) to pay school fees in a tax-efficient manner.

Here’s how it works:

1. A Grandparent (or Someone Who Isn’t a Parent) Sets Up a Trust

• The key rule is that parents cannot set up the trust, or HMRC will treat the income as theirs.

• A grandparent, for example, establishes the trust and transfers shares in a business into it.

2. Business Dividends Are Paid Into the Trust

• The trust holds shares in a business and receives dividend income.

• This income is then distributed to the child as a beneficiary.

3. Child Uses Their Personal Tax-Free Allowance

• A child has a personal tax-free allowance of £12,570 per year.

• If the trust distributes dividend income to them, it can be entirely tax-free if kept within this allowance.

4. Significant Tax Savings

• A parent paying 40% or 45% tax would normally need to earn significantly more to cover school fees after tax.

• With this trust structure, the dividends are taxed at the child’s much lower (or even zero) tax rate.

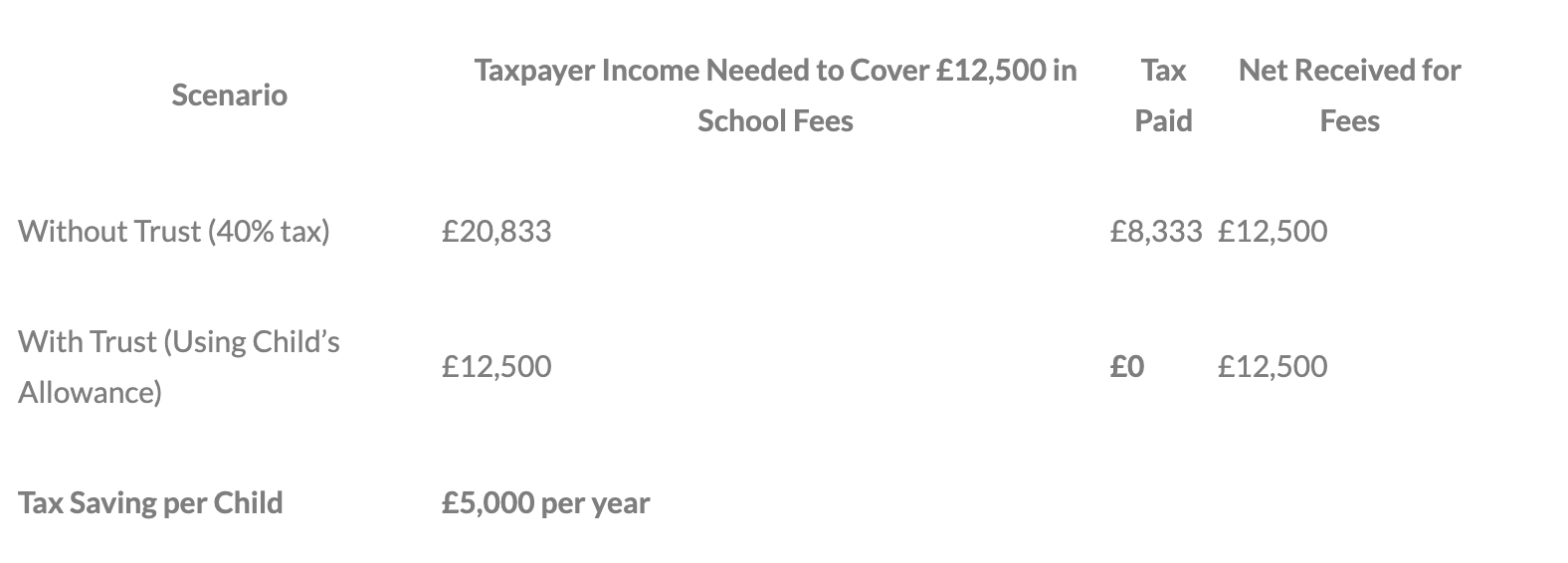

Example of Tax Savings

If two children are in private school, this could save £10,000 per year in tax for a higher-rate taxpayer.

Why This Matters More with VAT on School Fees

• The VAT increase means school fees will be even higher, making tax-efficient planning essential.

• Using this trust structure can offset some of the VAT impact, helping families keep education costs manageable.

• By saving up to £5,000 per year in tax, families can partially or fully cover the additional VAT charge.

Key Considerations

• The Trust Must Be Set Up Correctly: It must be established by someone other than the parents to avoid HMRC taxing it as parental income.

• Professional Advice is Crucial: Trusts are complex, and incorrect setup could negate the tax benefits.

• Not Suitable for All: This strategy works best for families with business-owning relatives who can distribute dividends.

Final Thoughts

With the looming VAT increase on private school fees, tax-efficient planning is more important than ever. Using a family trust can legally reduce tax liabilities and help offset the additional 20% VAT charge, potentially saving families thousands per year.

If you’re concerned about rising school fees and want to explore tax-efficient planning options, contact Enso Accountants for expert guidance on structuring your finances effectively.